Off-ramping: where and how to spend your cryptocurrency

💡 This is part of Violet Rollergirl’s Guide to Using Cryptocurrency (as a Sex Worker). If you haven’t yet read the primer, consider starting there!

At the end of the day, cryptocurrency is just currency. You can’t breathe it, you can’t eat it, you can’t drink it. It won’t provide companionship, fulfillment, inspiration, or joy. A number in a bank account, or a cryptocurrency wallet, won’t keep you alive. Sooner or later, you’re going to have to spend it on something.

The cryptocurrency world calls this “off-ramping,” the complement to “on-ramping.” In this case, it means turning your cryptocurrency assets into something else, whether digital or physical.

In the traditional financial system, spending money comes with a privacy trade-off: your bank, credit card company, or payment processor knows what you’re up to. Transparent (non-private) cryptocurrency systems suffer from the same problem, but worse, because everyone in the entire world can watch what you buy. This is one of the main safety benefits to using privacy coins: no one but you and the vendor you’re buying from knows what you’re up to.

In this article

- Paying directly in cryptocurrency

- Piggyback on the gift card economy

- Use crypto-native service providers

- Fund a traditional payment card using cryptocurrency

- Join a digital employment cooperative that accepts cryptocurrency

- Convert crypto back to fiat currency

Paying directly in cryptocurrency

The easiest way to off-ramp or spend your cryptocurrency is to just pay for the thing in the same privacy coin you already have. Of course, this requires the vendor to accept payments in that privacy coin, and that’s still rare.

It’s worth pointing out that, as sex workers, we are actually quite a skilled bunch. As I’m sure you know (and as I’ve said before), sex work requires myriad skills, and most sex workers are gig workers, which means you can support many of the sex workers you know even without buying hole or pole from us. I personally know colleagues who are editors, tailors, graphic designers, leather workers, bartenders, computer programmers, cooks, tutors, and nannies who also do sex work as a supplemental income.

Community’s always been important but it’ll become more so very rapidly. If the quality is there, I’d rather get my blouse sewn by a fellow sex worker I know or one who is recommended to me by a friend. And, guess what, if they’re willing to accept payment for that service in Zcash, I’ve got my perfect off-ramp right there!

So if you’re a sex worker with such skills, share that fact with friends you trust. Or maybe you’ve got a car, time, and need cash? Consider offering a Homobiles-style car service for your fellow workers and accept payments in ZEC or another privacy coin! Build a local economy, and stay surveillance-free by using Zcash to sustain it! The true revolutionary potential of this truly cannot be overstated.

One way to think about this is: Zcash in Zashi is to money what Signal Private Messenger is to speech. Vive la révolution!

Paying in Bitcoin when you only have Zcash

Although Zcash is a superior private currency, most of the crypto world still relies on other surveillable systems, like Bitcoin. Thankfully, cryptocurrencies can be easily converted from one to another so it’s easy to pay in a vendor’s cryptocurrency of choice even if you only keep a balance in Zcash. There are lots of ways to do this, but many are clunky and require you to be quite careful about exchange rates, conversion fees, and payment processing times.

By far the easiest method is Zashi’s “Crosspay” feature, so named because it can make “cross-chain payments” simple and safe. Let’s work through a common use case I have one step at a time and show Crosspay at work.

One very common need I have is to pay for my escort ads. Many escort directories and mall sites will accept payment in Bitcoin, but I’m aware of none who accept Zcash. (Obviously, if you know of one, please contact me to tell me about it!) This is where Crosspay shines.

Suppose you have some ZEC and you want to load up your Tryst TLC balance. Here’s what you can do.

💡 Remember that since you’re starting from holding ZEC in Zashi, it’s already shielded and private. This means no matter how you got it, the money we’re about to spend has no digital link back to your legal identity. This is a much better place to start than any other Bitcoin address.

-

First, log in to your Tryst account and access their “Add credits” screen.

- Since this is your first time paying in ZEC, choose to purchase a small “Custom” amount of TLC, maybe

15or so. -

Make sure you indicate that you want to pay in Bitcoin. You’re actually going to be paying directly from your shielded Zcash, but Tryst will nevertheless receive Bitcoin anyway.

- Click the “Next” button to proceed to the Tryst order summary screen.

-

Review your purchase order for correctness and press the “Pay Now” button to reveal the Bitcoin pay window.

- Tryst will show you a QR code that’s similar to Zashi’s “Request” screen, with an amount already embedded in it. That’s nice, but we’re not going to use it because that QR code is intended for Bitcoin wallet apps, and we’re using a Zcash wallet app.

-

Click on the “Copy” tab to reveal just the Bitcoin address that Tryst wants you to send your payment to. It’ll look like the right screenshot in the image below.

- Click on the address itself (not the “payment link”) to copy the Bitcoin address to your clipboard. Keep a note of this address somewhere, like a text window or just in your clipboard. We’ll need it later. I like to use Signal’s “Note to self” feature, which is also a secure way to send it to my other devices if I’m not already doing this all from one device.

- Now, open Zashi.

- Click on Zashi’s “Pay” button to open the Crosspay screen.

- Next, in the “Send to” section, enter the payee’s (Tryst’s) information:

- You’ll see a cryptocurrency selection drop-down menu for choosing the currency the payee wants to receive from us. Find Bitcoin (

BTC) from the list of options; it will have a small Bitcoin logo on top of a larger, second, identical Bitcoin logo. This means we’re using our shielded ZEC, but paying in Bitcoin. - In the

Addressfield, paste the Bitcoin payment address you copied from Tryst earlier.

- You’ll see a cryptocurrency selection drop-down menu for choosing the currency the payee wants to receive from us. Find Bitcoin (

- Now choose how much to pay by entering an amount in either Bitcoin units or, if you have enabled Zashi’s currency conversion feature in its settings, in fiat units.

- Click “Review” at the bottom of the Zashi Crosspay screen. Zashi’s “Pay Now” drawer will open.

- Review your payment and ensure that the fiat amount, if shown, will cover your Tryst TLC order.

- Click “Confirm” when you are ready to make your payment and send the transaction.

In my experience, it takes about 5 to 10 minutes for the transaction to complete, so make sure you also have at least that much time on the Tryst payment timer before you confirm your transaction, or you may not be able to get your account credited before your purchase order expires. If that does happen, you’ll have to speak with a support representative about crediting your account.

There’s a lot of sparkle-emoji technology sparkle-emoji happening here, but what’s extra cool about this is that at no point do you ever need a Bitcoin wallet! Moreover, no remnant of digital cruft exists anywhere in the various blockchains that can be meaningfully linked back to you. While the vendor you’re purchasing from may know who you are (and Tryst certainly does), they don’t know where your funds came from, and they don’t care.

Practically, this enables you to safely keep your cryptocurrency assets in the Zcash shielded pool, where they stay completely private, and still be able to pay any vendor who accepts any denomination of a supported cryptocurrency equally privately. If you do this, no one can know how rich (or poor) you really are. In contrast, if you keep your holdings in a transparent ledger system like Bitcoin, the whole world can tally your real net worth without ever asking you questions.

This is not a hypothetical example. This is in fact how I pay for my Tryst membership and other ads, as well as for the VoIP phone number I use for SMS inquiries. Consider trying it out for your next cryptocurrency payment, too.

Piggyback on the gift card economy

Among the most common ways to spend your hard-earned cryptocurrency today is by piggybacking on the massive gift card economy for making various kinds of retail purchases. One thing that’s nice about this for us as sex workers in particular is that many of us are already very familiar with gift cards and similar store credit services. We may even have regular business expenses such as a prepaid mobile phone (eSIM) line or hotel bookings we need to make to run our business.

Since gift cards and store credit systems are already a certain kind of alternative digital local currency, cryptocurrency is a natural fit. As a result, an entire crypto gift card marketplace industry has emerged to support this particular kind of off-ramp. While different crypto-to-gift-card vendors support different currencies, Zashi’s built-in decentralized exchange solves that problem, so the main considerations for those of us who want to use this method to spend our cryptocurrency funds are:

- finding a crypto to gift card exchange provider that partners with a brand we want to buy from, and

- ensuring that the exchange provider’s terms of use and their “Know Your Customer” rules doesn’t risk our privacy more than we are comfortable with.

I strongly suggest talking to your friends and colleagues about what services they like and feel safe using, and why. But if you’re just starting from scratch, read on to learn about my favorite vendors. Two of them conveniently, are built into the same self-custody wallets I’ve already recommended.

Pay for stuff via Flexa in Zashi

The gift card vendor directly integrated with the Zcash wallet app I use is called Flexa, which is basically a multi-store gift card manager mini-app inside the Zashi wallet app itself. If you’ve installed the mainstream version of Zashi (i.e., from the Google Play Store or the Apple App Store, but not from the F-Droid strictly free software app repository), you’ll have the option to spend your shielded ZEC at partnered Flexa brands from within your Zashi wallet.

As of this writing, some Flexa partners include Ulta Beauty and Kiehl’s (cosmetic and skincare product brands, useful for the obvious reasons), Sheetz (a convenience store and gas station chain, useful if you often drive yourself to outcalls), and Chipotle, which I guess is mostly noteworthy for personal reasons because one of my partners loves Mexican food, so I get to treat them here often. :)

First, set up Zashi to work with Flexa as privately as possible by enabling Zashi’s built-in Tor network privacy features. Once that’s set up do this to use Flexa from within Zashi:

- Open your Zashi wallet app. Make sure you have some ZEC in it, enough to cover the cost of the thing you’re about to buy in the local fiat currency where you’re buying it (such as in US Dollars if you’re in the United States).

- Tap the “More…” button in the Zashi main screen.

- Tap the “Pay with Flexa” item in the resulting list.

- If this is the first time you’ve used Flexa, you’ll be asked to complete a brief registration process where you are asked for your name and email address. At this point, there are a few things you should know:

- While Flexa will have this information, none of it will end up on the Zcash blockchain network nor with the ultimate merchant from which you are buying something.

- At the moment, Flexa limits your spending to $750 USD per week. As a result, Flexa is not required to share any of your off-ramping activity with the US government’s Internal Revenue Service (IRS, the tax man).

- I signed up with Flexa using a name that is not my legal name and an email address that is not one I use for my legal identity, and I was still able to buy stuff by funding it with my Zcash balance. You can do the same. (Try using Firefox Relay for your masked email address.)

- Once you have a Flexa account, you’ll be given a “Flexa QR code” that is basically just a barcode that participating brands can scan as a native payment. It’s that easy. But you’ll also see a “More instant payments” box at the bottom of your screen. These are “legacy Flexa brands,” which are the stores at which you need to tell the cashier that you want to pay using a “gift card” or “store credit.” To use these:

- Tap the logo icon for the brand you want to pay for. This will let you create a one-time use virtual gift card and load it up using your Zcash funds.

- Enter the amount you owe at the register. If the cashier tells you that your total is $20 USD, enter that amount under the brand’s logo.

- Press or tap the Confirm button. A new brand-specific virtual gift card QR code will appear.

- Tell the cashier you have your gift card ready. They will ask you to scan it. Do so, and you’ll have paid!

I have successfully used Flexa this way and, while it’s currently limited to supported business partners, it is by far the easiest way to spend my ZEC on real, physical stuff.

If you need something from a store that doesn’t have a Flexa partnership, you can still maybe find it from another cryptocurrency to gift card vendor.

Pay for stuff via Cake Pay in Cake Wallet

The gift card vendor directly integrated with the Monero wallet app I use is called Cake Pay. If you use their Web site instead of the in-app wallet integration, you can also use shielded Zcash to pay for the gift cards they offer.

TK-TODO: This section is not yet written, but it functions almost identically to Flexa in Zashi: sign up with a KYC-lite email address, either on the Cake Pay website or in the Cake Wallet app itself, and then choose a giftcard, pay for it from a Cake Wallet’s balance using Monero, since Monero is the one private cryptocurrency Cake Wallet supports, and then use the gift card as you normally would.

Note that as of this writing, Cake Pay is not compatible with Tor; you must disable Tor from within Cake Wallet’s settings to use Cake Pay.

Common cryptocurrency to gift card off-ramps (for sex workers)

When you’re using the gift card economy to spend your cryptocurrency, the first challenge is figuring out which service can get you a gift card from a brand you want to purchase from.

The cryptocurrency to gift card vendor I know most about is Bitrefill (referral link), because they’re one of the largest. Another popular one I use is Piggy.Cards (referral link).

Both Bitrefill and Piggy.Cards sells gift cards to a plethora of well-known brands by accepting cryptocurrency as payment for them. You can buy these even more privately by browsing the sites via Tor Browser. If or when you hit purchase limits, you can create a “basic account” with Bitrefill to get decently large spending limits ($10,000 USD per month). Signing up with any name and any working email you like will work fine. (I didn’t use a legal identity to sign up and have no trouble using the site.) If you want to give Bitrefill or Piggy.Cards a try, signing up with my referral links will also earn you (and me) additional discounts and initial spending money.

Join Bitrefill (via referral) Join Piggy.Cards (via referral)

Since there are so many purchases available at these sites, I’ve also compiled the below list to help you get a sense of what’s available and may be particularly useful for us as sex workers via this particular gift card off-ramping site.

- Digital pre-paid Visa credit card (via Bitrefill) - Perhaps the most generically useful crypto off-ramp via the gift card economy is simply a pre-paid credit card. You pay in crypto and get a legitimate digital pre-paid credit card number that has a fiat balance you paid for using your cryptocurrency balance. You can also get physical pre-paid credit cards mailed to you.

- Amazon Gift Card (via Bitrefill) - This gift card is good for anything sold at Amazon.com, not that I’m trying to encourage you to give Daddy Bezos more money, but, y’know….

- Ulta Beauty Gift Card (via Bitrefill) - Ever since I started using cryptocurrency more in my everyday life, this cosmetics retailer has become my go-to for makeup and simple skincare needs. Flexa from within the Zashi wallet app also supports filling Ulta Beauty gift cards.

- Amtrak Gift Card (via Bitrefill) - Since I service clients in numerous cities clustered along Amtrak lines on the United States’ East Coast, this is a particularly convenient off-ramp for me and I imagine other TMTY providers would want to know about it, too.

- Lyft Gift Card or Uber Gift Card (via Bitrefill) - For the obvious reasons.

You can also find gift cards for other common sex worker needs, including airline and hotel bookings, at gift card off-ramping sites like these. However, remember that the gift card economy is still actually part of the fiat economy. When possible, it’s best to avoid converting your cryptocurrency back to fiat currency, whether to avoid privacy incursions or simply due to the inconvenience. That’s where crypto-native services come in.

Use crypto-native service providers

Instead of gift cards, which is really just a roundabout way to help fiat economy vendors accept cryptocurrency without actually accepting cryptocurrency payments, there are also a class of business-to-consumer (B2C) middlemen that will accept payments in cryptocurrency and either interface with vendors on your behalf or provide services paid for in crypto themselves.

Booking hotel stays and air travel with cryptocurrency

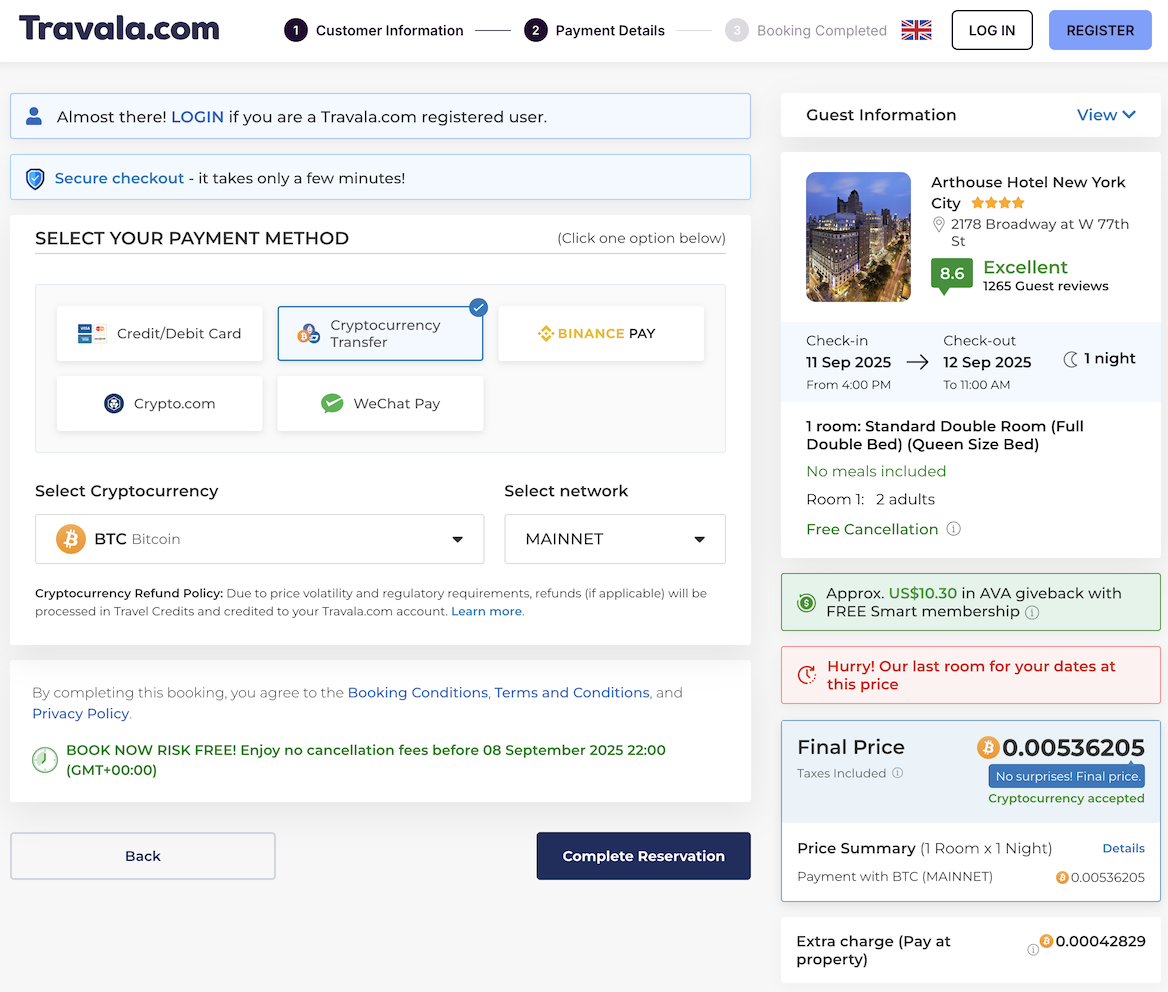

When I’m on tour, I often need to buy airline tickets to travel or make hotel arrangements to coordinate an incall. This is where Travala (referral link) comes in clutch. It works like you’d expect any other flight and hotel booking platform to work, but you can pay directly in cryptocurrency. They also have a loyalty program, so you can earn extra rewards, and help me do the same if you sign up via my referral link.

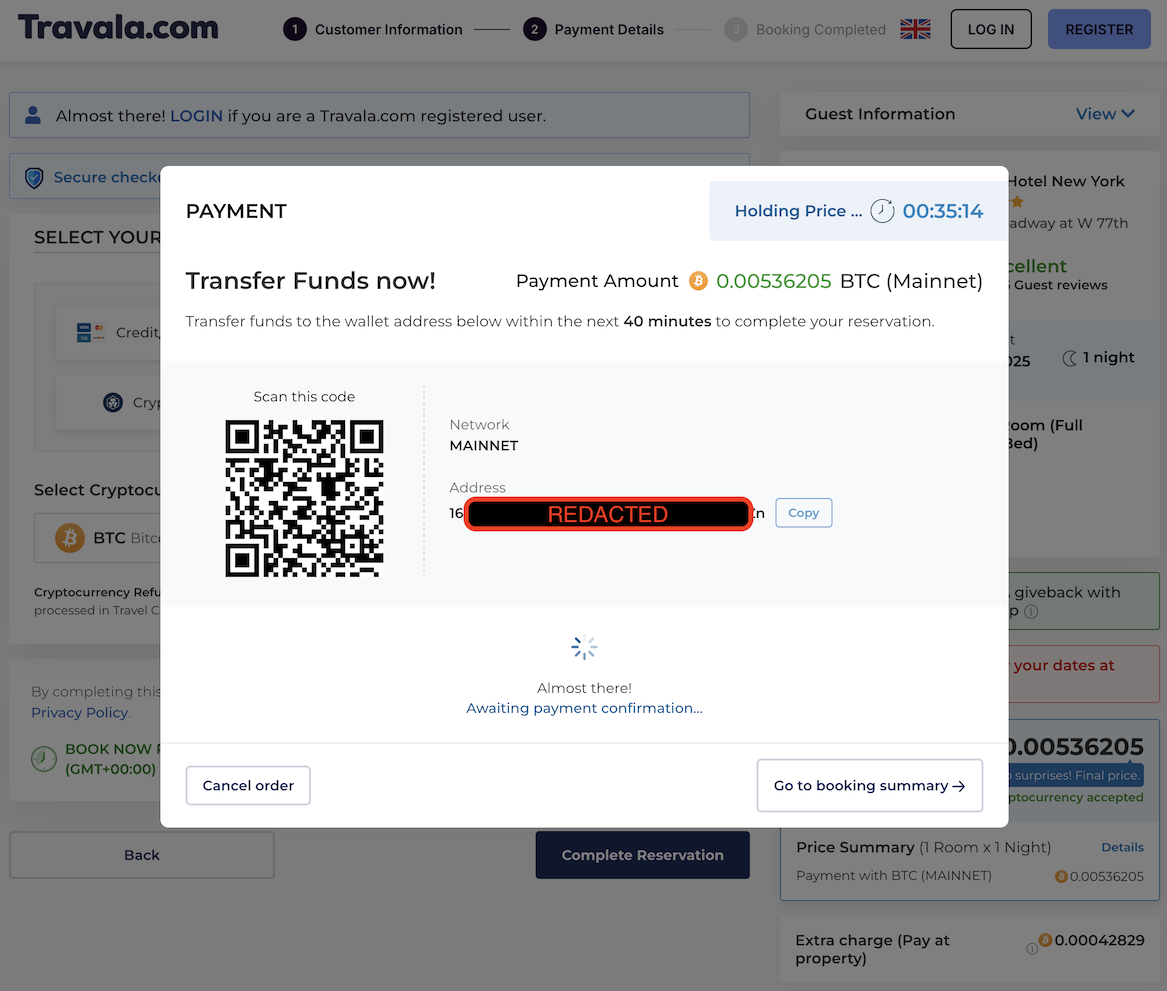

Perhaps the fastest way to demonstrate how this service works is to just watch what happens at its payment screen.

Travala’s payment options includes direct cryptocurrency transfer with dozens upon dozens of different supported cryptocurrencies, including the popular ones. While Travala doesn’t support Zcash directly, remember you can still use Zashi’s decentralized off-ramp to pay in Bitcoin or whatever other cryptocurrency you like directly from your Zcash balance.

Here’s a screenshot of a reservation made on their site about to get paid in Bitcoin.

And here’s what happens when you press the “Complete Reservation” button.

Kinda looks like Tryst’s payment screen, doesn’t it?

You can also buy airline tickets on Travala this same way.

Buying VoIP phone services with cryptocurrency

Earlier, I showed you how to off-ramp using the gift card economy, which is one way you can buy prepaid phone and data plans. However, there are also some VoIP providers that will accept payment directly in crypto. Here’s a short list:

- JMP.chat - This VoIP provider is really a hosted Jabber/XMPP (instant messaging) service with a paid VoIP gateway. You give them Bitcoin, they give you a phone number. You can even sign up and use the service over Tor for more privacy. JMP.chat deserves its own exposition, but for now, just know it’s an option if you are comfortable getting through an unusual sign-up process.

Please contact me to let me know if you found any more quality VoIP providers that accept crypto payments!

Buying VPN services with cryptocurrency

Another common service many of us have need for is a reliable VPN. I have a lot of thoughts on the topic of private network technologies, which can mostly be summed up by preference for using Tor over a VPN but with that said, if you’re going to use a VPN, you should probably stick to a reputable one that you can pay for in cryptocurrency. Here are my favorite options for that:

- MullvadVPN - Based on a traditional VPN technology called Wireguard, Mullvad also accepts payments in Bitcoin.

- NymVPN - Nym is a novel VPN technology that requires a subscription to use, but not only is it reputable, you can pay for Nym with shielded Zcash.

- ProtonVPN - Many providers know this company for their ProtonMail service, but Proton also accepts Bitcoin for their VPN product, which can implement either a Wireguard or SSL/TLS-based VPN.

Paying for client screening services with cryptocurrency

Much like employers pay vendors to perform background checks on individuals before granting those people access to their systems, one widespread industry norm for providers who meet with clients in person is to assess their safety through screening procedures before we grant those clients access to our bodies.

(Yes, I require each new client to screen in some way, although I offer a few alternative screening methods.)

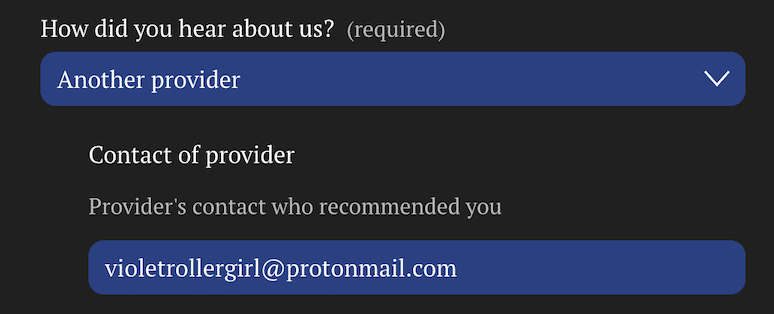

While some providers do these checks ourselves, there are also specialized services that can perform such screenings for us. Here are ones that I can recommend and that will accept cryptocurrency as payment:

- Laura Cohen Precautionary Investigations - Long-standing industry-specific screening service with a stellar reputation.

- Please use me as a reference by entering my email address (

[email protected]) because I get referral credits and it will save me money:

- Please use me as a reference by entering my email address (

Always remember that Bitcoin payments are never anonymous so, for your protection, I recommend paying using Zashi’s Crosspay feature, same as you would pay for your Tryst ad.

Fund a traditional payment card using cryptocurrency

If you don’t need the more complete privacy guarantees of off-ramps available via KYC-lite options such as gift cards, you can also apply for (and hopefully receive) a refillable, cryptocurrency-backed, payment card with a major traditional card issuer.

Since these are the equivalent of physical credit cards, you will have to upload your legal identity documents during the application process, meaning this off-ramp only provides partial privacy. Still, its convenience may be useful for workers who only need privacy from individual clients, rather than also from corporate or government institutions, or who simply need an off-ramp to spend their more private cryptocurrency earnings.

The biggest advantage of these cards is:

- they can be used for anything a normal credit card can be used for, like rent and utilities payments, which are situations in which even prepaid Visa gift cards may not always work.

- they don’t require a bank account to pay off, making this option especially attractive for sex workers who have already suffered banking discrimination and are having trouble using or opening a traditional checking or savings account.

By on-ramping directly in crypto and then funding a payment card like this, you simply don’t need to deposit your earnings into a bank account before you can fund the balance of your crypto-backed payment card.

Apply for a Payy Card, a crypto-backed Visa payment card

Payy (referral link) is a self-custodial, privacy-centered cryptocurrency wallet and payment gateway able to interface with Visa’s payment processing network. This makes Payy two things at the same time:

- a digital payment app, much like a cryptocurrency version of CashApp, Venmo, or PayPal, which makes it easy to do the kinds of things you might currently be using those apps for in your civilian life (pay back friends for dinner, for example).

- a Visa payment card paid for with cryptocurrency, but usable anywhere traditional Visa credit cards are accepted.

What’s appealing about Payy is that you can fund your Payy Card’s balance using either fiat currencies, such as from traditional bank accounts, or cryptocurrency sources, such as other crypto wallets or exchanges, by converting whatever cryptocurrency you have into USDC on Polygon (the same currency that MintPay lets you withdraw). This makes it feasible for de-banked individuals to buy things the way most of the banked population does, without needing to get a bank account, which is no small feat.

It’s important to remember that payments you make using a Payy Card are associated with your legal identity. From that perspective, it’s not more private than a regular credit card. However, it is a lot more private than just using Bitcoin, Ethereum, or other transparent-ledger cryptocurrency systems directly, because your payments aren’t published publicly for the entire Internet to see.

Payy itself communicates what data is public and what data stays private when you sign up for a Payy Card. Here’s the infographic I was shown when I applied for my Payy Card:

I would not recommend using your Payy Card or the Payy network for your sex worker needs if you can avoid it; do your best to stick with Zcash and Monero for that. However, if your friends are unwilling to adopt the stronger privacy protections offered by Zcash in Zashi, are scared of the volatility of actual privacy coins, or have otherwise succumbed to the propaganda that stablecoins are somehow superior (even though we know they’re not), Payy can be a convincing half-step to at least get them using cryptocurrency with you.

Your Payy Card can make you look more like a “normal” civilian in your personal life. And you can still keep your wealth private by having it in and moving it through the Zcash shielded pool (i.e., Zashi) at every opportunity.

If you’d like to try Payy, using my invitation link will net me “Payy Points,” which act a bit like a credit card loyalty program:

Payy is also the same company that underpins the MintStars Creator Card.

Join a digital employment cooperative that accepts cryptocurrency

So far, the cryptocurrency off-ramping options I’ve described largely avoid unnecessary interaction with the fiat economy. Turning away from traditional financial and governmental systems is becoming increasingly important. However, it can also brand us illegitimate to individuals or institutions who do interact with that world and who, for whatever reason, we are also forced to interact with.

Unfortunately, lacking traditional legitimacy often means lacking important safety nets that come with traditional employment, like medical/health insurance and retirement plan benefits. It also means struggling to show proof of income in many situations where we still need it, such as taking out a fiat loan or renting from a landlord. Crucially, we as sex workers are not alone in this frustration! While stigma against sex work puts up even more obstacles for us in these situations, on paper at least these challenges are similar to those faced by freelancers more generally.

Let me be absolutely clear: I firmly believe the current system is unredeemable. As the fiat world continues failing to provide many of us our most basic needs, alternatives will be urgent sooner rather than later. On a personal level, I don’t even care why this empire is crumbling; whether my government failed me out of malice or whether it failed me because it’s incompetent is not something I have the luxury of thoroughly investigating. I just need a solution, and I need it yesterday.

One novel angle from which to attack this problem comes in the form of digital employment cooperatives, sometimes also called a freelancer’s union (not to be confused with The Freelancer’s Union). If you can join these institutions, they offer a way to legitimize your income, whether fiat or cryptocurrency. This means you get some of the benefits of traditional employment while retaining the freedom of being an independent worker.

Despite not being suitable for or available to everyone, this kind of thing is still worth knowing about. So, let’s look at one such off-ramp next.

Opolis: a crypto-native independent employment platform

Opolis (referral link) is a novel digital employment cooperative you may be able to join (if you meet minimum income or eligibility requirements based on your needs, see below) that can offer a way to legitimize your income, including any earnings from cryptocurrency transactions. With Opolis, rather than work “under the table,” you set things up like a traditional business, funnel your earnings through that business, and then pay yourself back as a salaried employee.

After reading this, if you want to join Opolis, you can help me by joining via my referral link:

In plain language, the whole setup works like this.

- Register a legal business entity, such as an S-Corp that, obviously, provides high-quality “consulting,” “coaching,” “personal continuing education,” or similar kinds of services. I’m being perfectly honest when I say I’ve discussed nuances of the JavaScript programming language with some of my clients! My state of dress during those discussions is neither here nor there.

- You then hire yourself as an employee of that business, so you can pay yourself a salary out of the business’s future revenue.

- Your business entity then partners (joins) with the Opolis business cooperative, which collectively negotiates employee benefits like health insurance plans.

- Finally, your business in turn offers those employment benefits to you, the “human resource” (employee).

Yes, this tactic introduces complexity to your work. It means you have to go through the process of registering a business, like picking a name and choosing which State is best for you to register your business in. But the rubber meets the road when on-ramping same as it did before, if not even better.

- Getting paid directly in crypto is no different, just show a client your QR code from a cryptocurrency wallet.

- You can use your registered business as a further shield to protect your individual privacy for accepting fiat payments like deposits when using your corporate bank account linked to fiat payment apps, notably Zelle. Just make sure you’ve registered your business in a privacy-friendly state like Delaware, Nevada, or Wyoming, and via a third-party registered agent so that you don’t have to list your legal identity as a publicly disclosed member of the corporation.

Now that you’re earning revenue on behalf of your business, you’ll need to record those funds in some accounting software. (I prefer to use GnuCash for this, but I’ve also heard good things about Rotki.) This way, you can treat it as your business’s taxable income for reporting when your business pays member dues in the cryptocurrencies Opolis supports. Yes, it also means you’re now going to pay taxes; that’s the cost of fiat legitimacy.

As a trans sex worker, my main motivation for looking into this option is my need for safe and reliable HRT medicine (it’s expensive to be trans in America). Unfortunately, Opolis has minimum income requirements that puts it out of my reach, at least for now. But when (not if 🙏🏻) I eventually make enough to meaningfully benefit from further professionalizing my independent business this way, this business cooperative approach seems like a good one.

A few other points to know about this off-ramp:

- I will personally vouch for Opolis being as sex worker friendly as they need to be for someone like me to join.

- They’re not tracking your hours or looking into the specifics of your business or clientele.

- When meeting with their agents, I was not subtle about what industry I’m in. The agent I spoke with did not bat an eye, and didn’t pry.

- Also, you don’t need to be earning all of your income from sex work to join. What matters is how much you’re making in total so that you (as a business) can afford to run payroll while covering operating expenses, employee compensation (salary and benefits), and paying taxes or other applicable fees.

- No, this is not likely to be feasible for survival sex workers. For some mid-range or higher-end escorts, part-time workers, or sex workers who also freelance in civilian industries as gig workers, however, joining a digital employment cooperative like this one could both level up their business and further integrate them with the cryptocurrency economy.

I’d love to hear about your experience if you try something like this so please don’t hesitate to reach out to me if you do!

Convert crypto back to fiat currency

I need to write this up, too. Basically it’s just going back to an exchange where you are okay KYC’ing to your fiat identity.